Search

CATEGORIES

We found 19 books in our category 'TAXES'

We found 19 news items

We found 19 books

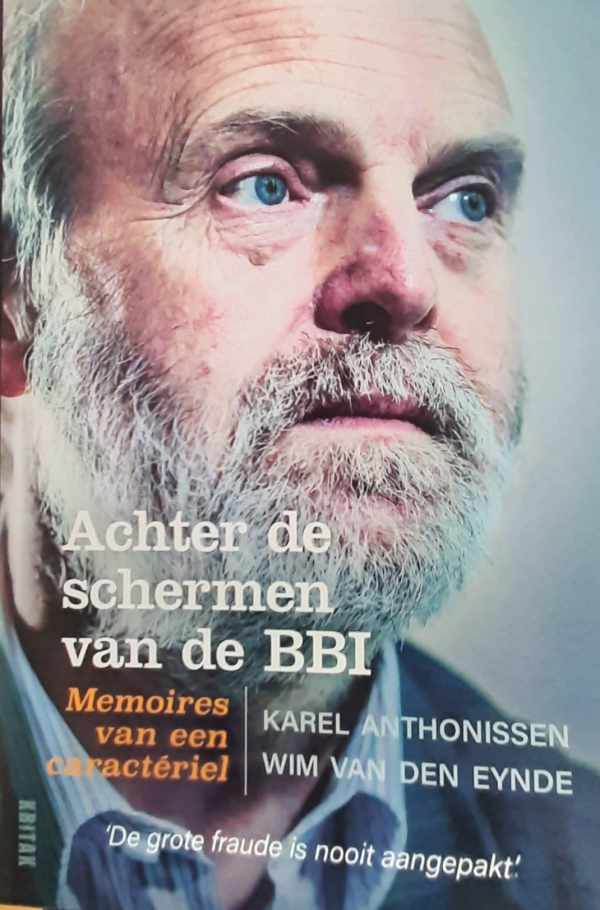

De langverwachte memoires van Karel Anthonissen (°1954) over de mankementen van onze fiscus. Er loopt heel wat grondig mis met onze belastinginning. Er zitten zo veel mazen in het net dat de fiscus een pak minder ophaalt dan waar de staat recht op heeft. Dat is een van de redenen waarom de overheid moet lenen en waarom we een grote staatsschuld hebben. Wat het nog erger maakt, is dat de belastingontwijking heel ongelijk verdeeld is. In de praktijk geldt het omgekeerde van de officiële filosofie van ons belastingstelsel: de sterkste schouders torsen de kleinste last.

Hardcover, relié, jq, in-8, 870 pp., notes bibliographiques, bibliographie, index. Collection 'Les Grandes Etudes Historiques'.

Hardcover, relié, jq, in-8, 870 pp., notes bibliographiques, bibliographie, index. Collection 'Les Grandes Etudes Historiques'.Qu'on se souvienne des efforts accomplis par un Richelieu, un Pierre le Grand, en Russie, et bien d'autres, pour construire des Etats modernes sur des sociétés agraires inaptes à subir leurs prélèvements.

L'histoire de l'impôt est donc celle des sociétés, vue au travers de ce qui leur a permis de s'affranchir du régime du pillage comme du système hiérarchisé de prestations de biens et de services, pour arriver à la lente construction des Etats actuels.

En montrant dans cet ouvrage l'incidence constante de l'impôt sur les événements politiques et économiques, l'auteur projette un éclairage nouveau sur bien des problèmes qui sont aujourd'hui d'une actualité brûlante.

L'auteur:

Inspecteur général des Finances, ancien commissaire général à la Productivité, docteur ès lettres, Gabriel Ardant a toujours considéré que l'expérience professionnelle devait éclairer la science et l'histoire, et réciproquement. Tous ses ouvrages tels " Technique de l'Etat ", " Le Monde en friche " s'insèrent dans cette ligne.

Niet zomaar een boek over belastingen.

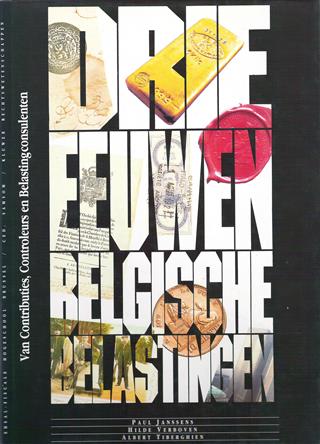

GENUMMERDE BIBLIOFIELE EDITIE: nr 97/150. GESIGNEERD DOOR DE 3 AUTEURS EN DOOR WILLY MAECKELBERGH. Hardcover, gebonden in zwart kunstlederen band met goudopdruk, geïllustreerde stofwikkel, 4to, 432 pp., 350 ZW en kleurillustraties, bibliografie, Summary in English, (Handbook on the history of three centuries Belgian taxation). Zeldzaam. TOEGEVOEGD: ERRATA OP 1 PAGINA A4. Noot LT: nooit werd het verhaal van de belastingen zo boeiend in woord en beeld gebracht. Referentiewerk van topniveau dat ons steeds doet beseffen dat zonder belastingen een Staat niet bestaat.

GENUMMERDE BIBLIOFIELE EDITIE: nr 97/150. GESIGNEERD DOOR DE 3 AUTEURS EN DOOR WILLY MAECKELBERGH. Hardcover, gebonden in zwart kunstlederen band met goudopdruk, geïllustreerde stofwikkel, 4to, 432 pp., 350 ZW en kleurillustraties, bibliografie, Summary in English, (Handbook on the history of three centuries Belgian taxation). Zeldzaam. TOEGEVOEGD: ERRATA OP 1 PAGINA A4. Noot LT: nooit werd het verhaal van de belastingen zo boeiend in woord en beeld gebracht. Referentiewerk van topniveau dat ons steeds doet beseffen dat zonder belastingen een Staat niet bestaat.Pro memorie: Onmiddellijk na de bezetting van de Oostenrijkse Nederlanden door de Franse revolutionairen worden in 1794 de fiscale vrijdommen afgeschaft: "AVERTISSEMENT; Le Magistrat de Bruxelles avertit le public, qu'il a donné les ordres le plus positifs à la Trésorerie de cette ville (Bruxelles, LT), de ne plus permettre qu'aucun habitant puisse jouir de l'exemption d'aucun impôt, sous quelque prétexte que se puisse être. s. J.F. DE MENDIVIL." (zie p. 153)

Op p. 38 vindt men de informatieve kaart van 'De Belgische Provincies en de Zuidnederlandse Vorstendommen uit de 18de eeuw' van de hand van Marie-Rose Thielemans. De opsomming daaronder is onmisbaar voor een begrip van de complexiteit van het 'Belgische' terrein tijdens het Ancien Régime.

Dat 'terrein' bestond uit volgende entiteiten:

•vorstendom of prinsbisdom Luik

•graafschap Namen

•hertogdom Brabant

•graafschap Henegouwen

•graafschap Vlaanderen

•heerlijkheid Mechelen

•hertogdom Luxemburg

•hertogdom Bouillon

•het Doornikse

•Frans-Vlaanderen

•Landen van Overmaas (graafschap Dalhem)

•vorstendom Stavelot-Malmédy

•hertogdom Limburg

Op pp. 44 e.v. vindt men een gedegen uitleg over de Provinciale Staten en hun inspraak in de fiscaliteit.

Op p. 88 een kaart van de Belgische Départements onder het Franse Bewind (1795-1815).

Op welk niveau wordt er nu eigenlijk beslist over belastingen en over een vermogensbelasting in het bijzonder? In de coulissen van de macht, stupid.

In 2010 vertegenwoordigde de zwarte economie 17,9 procent van het Belgische BBP. (studie van Friedrich Schneider) (p. 96)

Kritiek: 1) In zijn historisch overzicht (hfst 5) slaat Michel Maus de Franse Revolutie over. Wil dit nu net de periode zijn die leidde tot een zeer grote ongelijkheid in de (onroerende) vermogens of - beter - de vermogens aan de top van de piramide verplaatste.

2) Het boek bevat geen voet- of eindnoten en er is ook geen bibliografie aanwezig. Daardoor blijft het ondermaats.

3) Er wordt te weinig beklemtoond dat de overheid zelf de belastingontduiking 'stuurt' in deze of gene richting en dat de groten vaak de dans ontspringen omdat zij de fiscale spitstechnologie kunnen betalen.

Behandelt zowel de federale als de gewestelijke materie.

Een geheel hoofdstuk is gewijd aan het 'onrechtmatig verkregen bewijs', een heikele materie.

Maar is Maus niet de vos die de passie preekt?

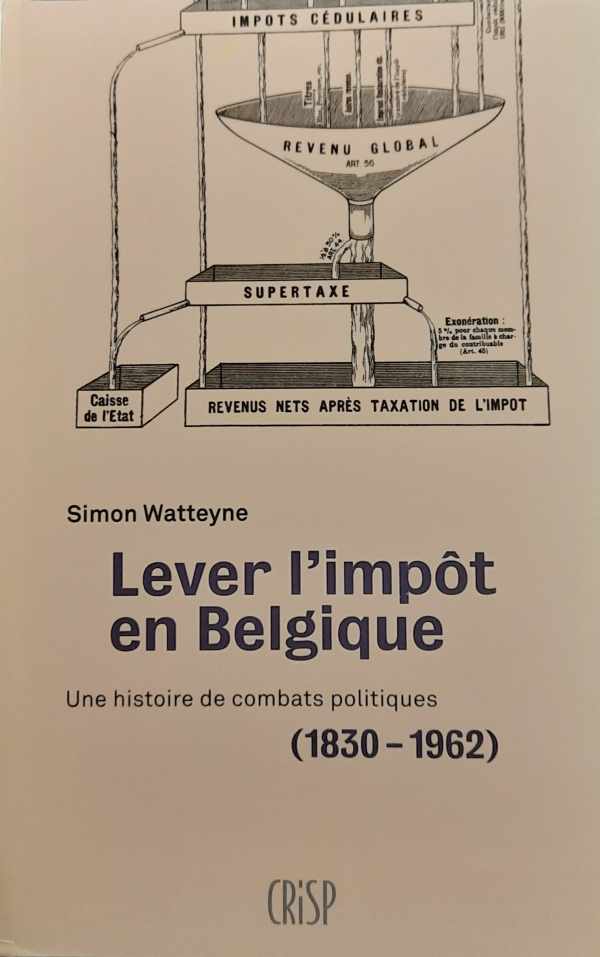

Paperback, in-8, 222 pp., bibliografische noten.

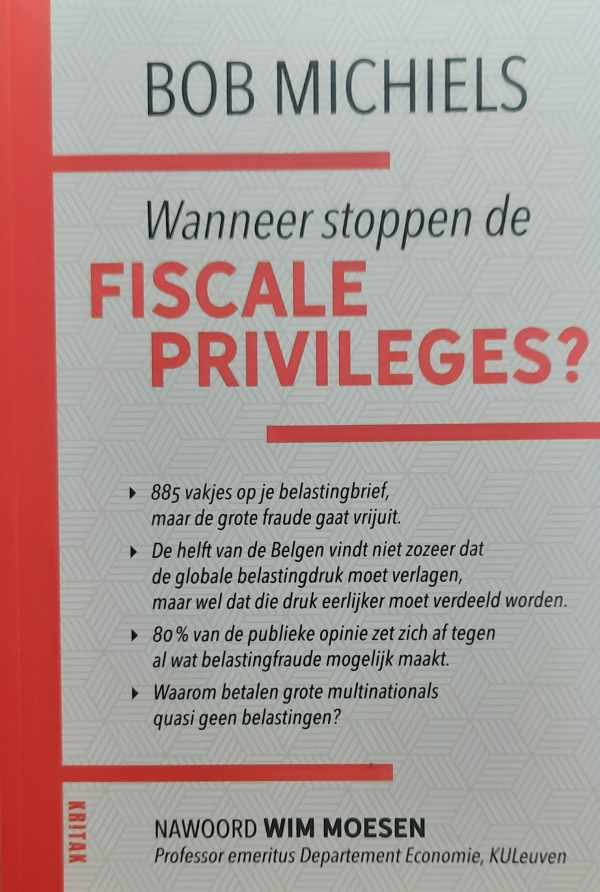

Paperback, in-8, 222 pp., bibliografische noten.- Twee op de drie Belgen vinden het huidige belastingsysteem onrechtvaardig. - De helft van de Belgen vindt niet zozeer dat de globale belastingdruk moet verlagen, maar wel dat die druk eerlijker moet verdeeld worden.

- 80% van de publieke opinie zet zich af tegen al wat belastingfraude mogelijk maakt.

- De sociale ongelijkheid en de armoede worden door de coronapandemie nog verder uitgediept, waardoor het noodzakelijk wordt dat iedereen - dus ook de rijksten - financieel bijdragen. Het is totaal abject dat ons huidig belastingbeleid grote multinationals van belastingen vrijstelt, waardoor miljarden voor de samenleving verdwijnen, die vervolgens via bezuinigingen in de gezondheidszorg, de uitkeringen, de cultuur en het onderwijs moeten worden gerecupereerd.

- Een vermogenskadaster is niet alleen technisch haalbaar, het zou zelfs op enkele maanden een feit kunnen zijn. Alleen de politieke wil ontbreekt.

- Wat is het belang van LuxLeaks, SwissLeaks, BahamaLeaks, de Panama Papers, de Paradise Papers? De bekendste topeconomen pleiten ervoor om de rijken opnieuw te gaan belasten op basis van hogere tarieven voor de hoogste schijven, zoals in de gouden jaren '50-'60 van de vorige eeuw toegepast, zonder de economische hoogconjunctuur in gevaar te brengen.

Nawoord van Wim Moesen, Professor emeritus Departement Economie, KU Leuven.

Bron: Flaptekst, uitgeversinformatie.

Noot LT: Dat de uitgever zo'n verhelderend boek uitgeeft zonder namenregister mag een beroepsfout en luiheid worden genoemd. Foei, Lannoo/Kritak. Daarom hebben we de moeite genomen om zelf een vereenvoudigd register aan te maken: Fernand Huts, Alexia Bertrand, Emmanuel Levinas, John Stuart Mill, Thomas Piketty, Adam Smith, Noreena Hertz, Leonardo Boff, Shell, Apple, Walmart, Hobbes, Paul Verhaeghe, Mark Elchardus, Branko Milanovic, Donald Trump, Frank Vandenbroucke, Erik Schokkaert, Koen Raes, Marc Coucke, Charles Michel, Johan Van Overtveldt, CMA-Medina, Gino Deraedt, Frederica Verheyden, Sacha Dierckx, Oxfam, Klaus Schwab, World Economic Forum, Bert Bultick, Knack, Theo Franken, Bart De Wever, Ingrid Robeyns, Bill Gates, Jeff Bezos, Marc De Vos, Joseph Stiglitz, Isha Ambani, Anand Piramal, Hillary Clinton, John Kerry, Beyoncé, Sarah Kuypers, Ive Marx, Jos Geysels, Erik Vlaminck, Apache, Crédit Suisse, Matthias Somers, Minerva, Marc Reynebeau, Egbert Reynebeau, Margrethe Vestager, Tim Cook, Steve Jobs, Laurene Powell Jobs, Forbes, Emiel Dullaert, MacKenzie Scott, Gabriel Zucman, Ingrid Robeyns, The Guardian, Elon Musk, SpaceX, Joe Biden, Marco Van Hees, Van Peteghem, ICIJ, Maagdeneilanden, Mauritius, Bahama's, Bermuda, Cyprus, Nederland, Luxemburg, Starbucks, Google, Amazon, Apple, Dexia, Fortis, Ikea, GAFA, PriceWaterhouseCoopers, Jean-Claude Juncker, Lars Bové, Disney, Kaaimaneilanden, Wedco, Jan Van de Poel, EURODAD, Christian Aid, OESO, Common Consolidated Corporate Tax Base, Europese Raad, EURACTIV, David Bowie, Joan Collins, John Malkovich, Michael Schumacher, Paul Bocuse, Marokko, Bahrein, Saudi-Arabië, Baby Doc Duvalier, Haïti, HSBC, Michel Claise, Mossack Fonseca, Moebarak, Juan Carlos, Xi Jinping, Poetin, Pedro Almodovar, Dominique Strauss-Kahn, Lionel Messi, Michel Platini, Franco Dragone, de Spoelberch, UBS, Société Générale, Royal Bank of Canada, KBC, Bank Degroof, Pierre Moscovici, Michel Maus, BBI, Kristof Calvo, PVDA, PTB, Peter Vanvelthoven, Facebook, Nike, Madonna, Bono, Jared Kushner, Justin Trudeau, Queen Elisabeth II, Trouw, Tim Cook, Wouter Lips, Jersey-route, Jan Tuerlinckx, Michel Maus, Gibraltar, Louise Hoon, Janet Yellen, IMF, Internationaal Monetair Fonds, China, India, Alex Cobham, Didier Reynders, de Mévius, Van Damme, Frère, Huts, Colruyt, De Nul, Ackermans & van Haaren, Singapore, Fernand Huts, Kent, Guernsey, Mont Saint Michel Trust, Zonamerica Ltd, Uruguay, Montevideo, Phoebus Foundation, Jan Jambon, Liechtenstein, Peter Bernaerts, Bernard Arnault, Louis Vuitton Foundation, Saatchi Gallery, Robrecht Vanderbeeken, ACOD, Carlos Slim, John Crombez, Elio Di Rupo, Peter Mertens, BEL20, Jan Rosier, Eurostat, François-Xavier de Donnea, Stefaan Van Hecke, Jean Gol, Bernard Clerfayt, Frank Philipsen, Dirk Van der Maelen, Herman Van Rompuy, Armand De Decker, Chodiev, Tractebel, Walter De Smedt, Yves Liégeois, Omega Diamonds, Peter Van Calster, Karel Anthonissen, Fincel Files, Belfius, BNP Paribas Fortis, Lesbos, Ronald Commers, Rik Pinxten, Sacha Dierckx, John Maynard Keynes, Boël, AB Inbev, Vlerick, Bosteels, Bostoen, Delhaize, Lhoist, Berghmans, d'Ieteren, Van Hove, Alexander De Croo, Koen Geens, Boelwerf, Karel De Gucht, Luc Van der Kelen, Ludo Cornelis, Eric Goeman, NV Ranson-Cannière, Pieter Timmermans, Isabel Albers, Bilderberg, Pascal Saint-Amans, Herman Matthijs, Leonce Eraly, Theo Klingels, Financieel Actie Netwerk, Rekenhof, Marc Leemans, VOKA, Bruno Peeters, Dries Lesage, Anton Delbarre, Comeos, Vitor Gaspar, Paul Krugman, Barack Obama, Liliane Bettencourt, l'Oréal, Paul De Grauwe, Anthony Atkinson, John Vandaele, Sarah Kuypers, Bruno Blondé, Wouter Ryckbosch (123), Vincent Van Quickenborne, Luc Coene, Anton Delbare, Ultimate Beneficial Owne (UBO), Sacha Dierckx, Gwendolyn Rutten, Bart Van Craeynest, Macron, Joël De Ceulaer, Franklin Roosevelt, Chantal Mouffe, Aristoteles, Mark Delanote, lvan Van de Cloot, Kantar, Paul Magnette, Carl Devos, Georges-Louis Bouchez, Bart Sturtewagen, Denis-Emmanuel Philippe, Assuralia, Dirk Verhofstadt, Liberales, Herman De Croo, Bart Somers, Karl Popper, Andreas Tirez, John Rawls, Ronald Dworkin, Ewald Pironet, Nicolas Bouteca, Mathias De Clercq, ram Wauters, Servais Verherstraeten, Joris Vandenbroucke, Thomas Dermine, Michaël Van Droogenbroeck, Kathleen Van Brempt, Frank Parkin, Daan Isebaert, Zakia Khattabi, Petra De Sutter, Bart Staes, BASF, Zara, Massimo Dutti, Pull & Bear, Wouter Beke, Peter De Roover, Edmund Burke, Herman De Bode, Thomas Nys, Bart Eeckhout, Pierre Wunsch, Eric Van den Broele, Graydon, Jan Denys, David Hope, Julian Limberg, Kevin Spiritus, Koen Schoors, Vincent Stuer, Thijs Delrue, Hans Vanaken, Club Brugge, Leen Dierick, Cercle Brugge, Jupiler Pro Ligue, Simon Mignolet, Ignace Vandewalle, Football Leaks, Thibaut Courtois, Sophie Wilmès, Erik Buyst (218).

Omdat we belastingen een vervelende materie vinden, laten we het aan de superrijken over om ze niet te betalen.

Paperback, in-8, 180 pp., geen illustraties, enkele tabellen, bibliografische noten.

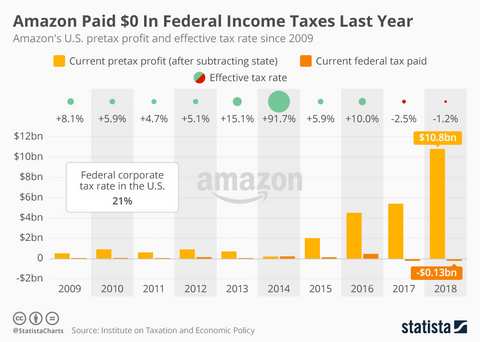

Paperback, in-8, 180 pp., geen illustraties, enkele tabellen, bibliografische noten.De tabel op pp. 22-23 is cruciaal en geeft de lijst van de 50 multinationale bedrijven die in 2011 konden genieten van in totaal bijna 17 miljard euro belastingverminderingen. Op een winst van 52,5 miljard euro vóór belastingen betaalden ze nauwelijks 0,9 miljard of 1,78 % belastingen.

Een stuitende vaststelling die aangeeft wie voor financieminister Didier Reynders belangrijk is: diegenen die rijk zijn hebben er alle belang bij hem in het zadel te houden.

Marco Van Hees is belastinginspecteur bij het Ministerie van Financiën.

Le désintérêt de la population pour le dossier fiscal est choquant. Toutefois, la politique fiscale d’un pays constitue la pierre angulaire de la démocratie.

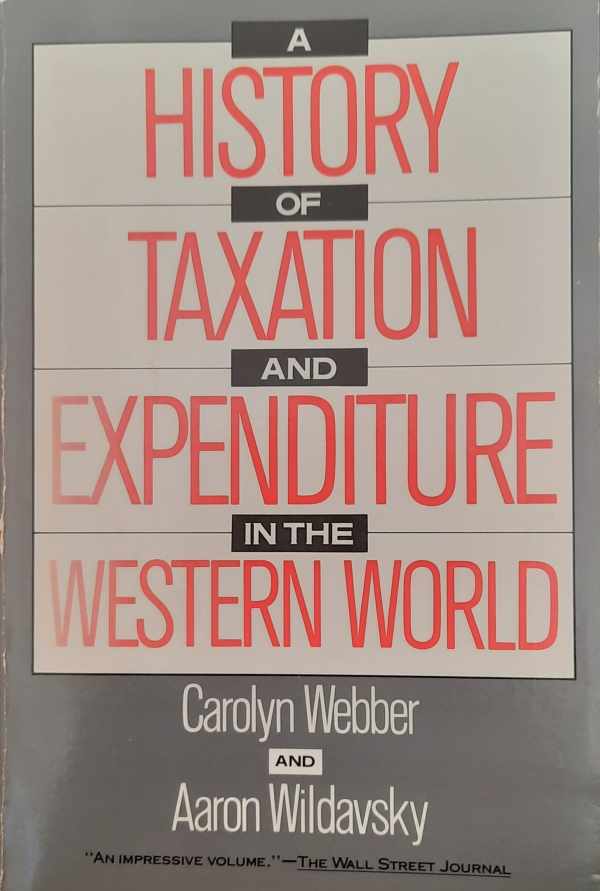

In this comprehensive analysis of social systems of taxation and budgeting, the authors provide detailed examples from ancient Mesopotamia and Egypt, Greece and Rome, the Middle Ages in Europe, and modern times to show how governments through the ages have raised money and spent it. They examine the two essential activities of government - taxing and spending - against the background of the societies in which they were imbedded and the development of government's administrative capacities. They also argue that government mobilization of resources involves critical human concerns waging war and providing for the welfare of the people.

About the Authors

Carolyn Webber is an associate specialist at the Institute of Urban and Regional Development at the University of California, Berkeley. She has also been an associate specialist with the Graduate School of Public Policy at Berkeley.

Aaron Wildavsky is a professor of political science and public policy at the University of California, Berkeley. He has also been president of the Russell Sage Foundation and dean of the Graduate School of Public Policy at Berkeley. His many books include The Politics of the Budgetary Process, Presidential Elections (with Nelson W. Polsby), Speaking Truth to Power, and How to Limit Government Spending.

We found 19 news items

Europe’s top human rights court upheld the conviction of whistleblower Raphaël Halet, a former PwC employee who downloaded tax records from a work computer that became a key part of Lux Leaks. The 2014 ICIJ investigation revealed how nearly 340 global firms slashed their tax bills by making confidential deals with the Luxembourg government. The exposé sparked momentum across Europe to end industrial-scale tax dodging.

The court ruled in favor of Luxembourg and PwC, an accounting giant that designed complex financial structures and helped clients cut deals uncovered in Lux Leaks — allowing some of the world’s largest companies to pay less than 1% tax.

But the decision was made with some strong opposition. Two judges penned a dissent stating that the ruling created an impossibly high bar for future whistleblowers to meet, stressing the importance of repeated leaks to reinforce public awareness around corporate tax dodging.

The ruling came out the same week that the European Union General Court ruled in favor of Amazon and Luxembourg in a case challenging another sweetheart tax deal — a setback in the European Commission's campaign to force Amazon to repay about $300 million in taxes.

Billionaire fortunes increased by 12 percent last year – or $2.5 billion a day - while the 3.8 billion people who make up the poorest half of humanity saw their wealth decline by 11 percent, reveals a new report from Oxfam today. The report is being launched as political and business leaders gather for the World Economic Forum in Davos, Switzerland.

‘Public Good or Private Wealth’ shows the growing gap between rich and poor is undermining the fight against poverty, damaging our economies and fuelling public anger across the globe. It reveals how governments are exacerbating inequality by underfunding public services, such as healthcare and education, on the one hand, while under taxing corporations and the wealthy, and failing to clamp down on tax dodging, on the other. It also finds that women and girls are hardest hit by rising economic inequality.

Winnie Byanyima, Executive Director of Oxfam International, said:

“The size of your bank account should not dictate how many years your children spend in school, or how long you live – yet this is the reality in too many countries across the globe. While corporations and the super-rich enjoy low tax bills, millions of girls are denied a decent education and women are dying for lack of maternity care.”

The report reveals that the number of billionaires has almost doubled since the financial crisis, with a new billionaire created every two days between 2017 and 2018, yet wealthy individuals and corporations are paying lower rates of tax than they have in decades.

Getting the richest one percent to pay just 0.5 percent extra tax on their wealth could raise more money than it would cost to educate the 262 million children out of school and provide healthcare that would save the lives of 3.3 million people.

Just four cents in every dollar of tax revenue collected globally came from taxes on wealth such as inheritance or property in 2015. These types of tax have been reduced or eliminated in many rich countries and are barely implemented in the developing world.

Tax rates for wealthy individuals and corporations have also been cut dramatically. For example, the top rate of personal income tax in rich countries fell from 62 percent in 1970 to just 38 percent in 2013. The average rate in poor countries is just 28 percent.

In some countries, such as Brazil, the poorest 10 percent of society are now paying a higher proportion of their incomes in tax than the richest 10 percent.

At the same time, public services are suffering from chronic underfunding or being outsourced to private companies that exclude the poorest people. In many countries a decent education or quality healthcare has become a luxury only the rich can afford. Every day 10,000 people die because they lack access to affordable healthcare. In developing countries, a child from a poor family is twice as likely to die before the age of five than a child from a rich family. In countries like Kenya a child from a rich family will spend twice as long in education as one from a poor family.

Cutting taxes on wealth predominantly benefits men who own 50 percent more wealth than women globally, and control over 86 percent of corporations. Conversely, when public services are neglected poor women and girls suffer most. Girls are pulled out of school first when the money isn’t available to pay fees, and women clock up hours of unpaid work looking after sick relatives when healthcare systems fail. Oxfam estimates that if all the unpaid care work carried out by women across the globe was done by a single company it would have an annual turnover of $10 trillion – 43 times that of Apple, the world’s biggest company.

“People across the globe are angry and frustrated. Governments must now deliver real change by ensuring corporations and wealthy individuals pay their fair share of tax and investing this money in free healthcare and education that meets the needs of everyone - including women and girls whose needs are so often overlooked. Governments can build a brighter future for everyone – not just a privileged few,” added Byanyima.

Afghan opium production has jumped to record levels this year. According to the latest "Afghanistan Opium Survey" released jointly by the Afghan Ministry of Counter Narcotics and United Nations Office on Drugs and Crime (UNODC), overall production rose by 87 percent compared to last year, to 9,000 metric tons. This is partly due to a 63 percent increase in poppy cultivated cropland, to 328,000 hectares in 2017. Also, the yield has increased by 15 percent to around 27 kilos of opium per hectare.

Afghanistan is the world's top cultivator of poppy from which opium and heroin are produced. The cultivation and sale is a source of revenue for the Taliban insurgency and other terrorist groups, as they levy taxes from farmers cultivating the crop. At the beginning of this week, the U.S. Air Force bombed production facilities in the south Afghan province of Helmand, which is the most prolific production area within Afghanistan.

The steep rise in production also means that more cheap but high quality heroin will be available on illicit markets across the world.

on the consumption side: overdoses rise in the USA

Pro memorie: Op 11 november 2017 bracht de VRT in het journaal een propaganda-reportage: de boeren in Afghanistan waren begonnen met het planten en oogsten van saffraan ... op 3.000 hectaren. Hoe goedgelovig kan je zijn? Met geen woord werd gerept over de enorme productiestijging in de opium-business.

Belgium has been ordered to recover $765 million in unpaid taxes from 35 multinational corporations after the European Commission said tax breaks granted to the companies were illegal.

The ruling was the latest in a series of investigations, led by European Union competition commissioner Margrethe Vestager, into special tax concessions offered by European countries to lure the business of multinational corporations.

Last year the commission made similar rulings against Luxembourg and the Netherlands concerning their tax deals with Fiat and Starbucks respectively. Investigations into Ireland’s tax arrangements with Apple and Luxembourg’s agreement with Amazon are ongoing.

The commission has not named the 35 companies affected by the Belgium ruling, but brewer ABInBev (which produces Budweiser, Stella Artois and other popular brands of beer) and BP are reported to be among them.

ICIJ’s Luxemourg Leaks investigation, published in 2014, revealed the inner workings of many of these types of secret arrangements that some of the world’s biggest companies make with government authorities in order to slash their tax bills.

On the same day the commission’s latest ruling was announced, an interview with commissioner Vestager was published by EurActiv in which she denounced Luxembourg’s decision to prosecute two whistleblowers and a journalist in relation to leaked tax documents.

“LuxLeaks could not have happened if it was not for the whistleblower and the team of investigative journalists. The two worked very well together to change the momentum of the debate about corporate taxation in Europe,” Vestager said.

“I think everyone should thank both the whistleblower and the investigative journalists who put a lot of work into this.”

The trial of whistleblower and former PricewaterhouseCoopers employee Antoine Deltour, another unnamed whistleblower, and journalist and ICIJ member Edouard Perrin is set to begin in Luxembourg on April 26.

President Obama's State of the Union address as prepared for delivery on Jan. 20, 2015:

Mr. Speaker, Mr. Vice President, Members of Congress, my fellow Americans:

(...)

Now, the truth is, when it comes to issues like infrastructure and basic research, I know there's bipartisan support in this chamber. Members of both parties have told me so. Where we too often run onto the rocks is how to pay for these investments. As Americans, we don't mind paying our fair share of taxes, as long as everybody else does, too. But for far too long, lobbyists have rigged the tax code with loopholes that let some corporations pay nothing while others pay full freight. They've riddled it with giveaways the superrich don't need, denying a break to middle class families who do.

This year, we have an opportunity to change that. Let's close loopholes so we stop rewarding companies that keep profits abroad, and reward those that invest in America. Let's use those savings to rebuild our infrastructure and make it more attractive for companies to bring jobs home. Let's simplify the system and let a small business owner file based on her actual bank statement, instead of the number of accountants she can afford. And let's close the loopholes that lead to inequality by allowing the top one percent to avoid paying taxes on their accumulated wealth. We can use that money to help more families pay for childcare and send their kids to college. We need a tax code that truly helps working Americans trying to get a leg up in the new economy, and we can achieve that together.

Read more ...

1. In most OECD countries, the gap between rich and poor is at its highest level since 30 years.

Today, the richest 10 per cent of the population in the OECD area earn 9.5 times the income of the poorest

10 per cent; in the 1980s this ratio stood at 7:1 and has been rising continuously ever since. However, the

rise in overall income inequality is not (only) about surging top income shares: often, incomes at the

bottom grew much slower during the prosperous years and fell during downturns, putting relative (and in

some countries, absolute) income poverty on the radar of policy concerns. This paper explores whether

such developments may have an impact on economic performance.

2. Drawing on harmonised data covering the OECD countries over the past 30 years, the

econometric analysis suggests that income inequality has a negative and statistically significant impact on

subsequent growth. In particular, what matters most is the gap between low income households and the rest

of the population. In contrast, no evidence is found that those with high incomes pulling away from the rest

of the population harms growth. The paper also evaluates the “human capital accumulation theory” finding

evidence for human capital as a channel through which inequality may affect growth. Analysis based on

micro data from the Adult Skills Survey (PIAAC) shows that increased income disparities depress skills

development among individuals with poorer parental education background, both in terms of the quantity

of education attained (e.g. years of schooling), and in terms of its quality (i.e. skill proficiency).

Educational outcomes of individuals from richer backgrounds, however, are not affected by inequality.

3. It follows that policies to reduce income inequalities should not only be pursued to improve

social outcomes but also to sustain long-term growth. Redistribution policies via taxes and transfers are a

key tool to ensure the benefits of growth are more broadly distributed and the results suggest they need not

be expected to undermine growth. But it is also important to promote equality of opportunity in access to

and quality of education. This implies a focus on families with children and youths – as this is when

decisions about human capital accumulation are made -- promoting employment for disadvantaged groups

through active labour market policies, childcare supports and in-work benefits.

Note LT: the famous book of Piketty (Capital) is not mentioned in the bibliography of this report!; Methodology: measurement of inequality with the use of Gini.

Read the report in PDF here ...

Find out more here

The econometric analysis of LI has identified 89 variables, which are spread across eight sub-indices:

1) Economy;

2) Governance;

3) Entrepreneurship & Opportunity;

4) Education;

5) Health;

6) Personal freedom;

7) Safety & Security;

8) Sociale Capital & Social Values.

Each of the 8 variables are subdivided in two: 1) having an effect on income 2) having an impact on wellbeing.

The sociological data were mainly retrieved from the Gallup World Poll.

Methodology for income and wellbeing scores. For each country, the latest data available in 2013 were gathered for the 89 variables. The raw values are standardised and multiplied by the weights. The weighted variable values are then summed to produce a country’s wellbeing and income score in each sub-index. The income and wellbeing scores are then standardised so that they can be compared.

Critical note LT: a) What we miss in the Prosperity Index is some kind of measurement of inequality and the measured effect of taxes on income redistribution (e.g. Gini before and after taxation). b) The GDP/capita is not critisized by Legatum Institute for being a variable not taking into account inequality.

src: The Guardian 20141117

(src: Nouvels Obs) - Good girl!

The International Consortium of Investigative Journalists collaborated with more than 80 journalists in 26 countries in its Luxembourg Leaks investigation, exploring the secret tax deals global corporations have made with Luxembourg. For Belgium MO Magazine, De Tijd and Le Soir were involved in the investigation.PricewaterhouseCoopers has helped multinational companies obtain at least 548 tax rulings in Luxembourg from 2002 to 2010. These legal secret deals feature complex financial structures designed to create drastic tax reductions. The rulings provide written assurance that companies’ tax-saving plans will be viewed favorably by Luxembourg authorities.

The International Consortium of Investigative Journalists collaborated with more than 80 journalists in 26 countries in its Luxembourg Leaks investigation, exploring the secret tax deals global corporations have made with Luxembourg. For Belgium MO Magazine, De Tijd and Le Soir were involved in the investigation.PricewaterhouseCoopers has helped multinational companies obtain at least 548 tax rulings in Luxembourg from 2002 to 2010. These legal secret deals feature complex financial structures designed to create drastic tax reductions. The rulings provide written assurance that companies’ tax-saving plans will be viewed favorably by Luxembourg authorities. Companies have channeled hundreds of billions of dollars through Luxembourg and saved billions of dollars in taxes. Some firms have enjoyed effective tax rates of less than 1 percent on the profits they’ve shuffled into Luxembourg.

Many of the tax deals exploited international tax mismatches that allowed companies to avoid taxes both in Luxembourg and elsewhere through the use of so-called hybrid loans.

In many cases Luxembourg subsidiaries handling hundreds of millions of dollars in business maintain little presence and conduct little economic activity in Luxembourg. One popular address – 5, rue Guillaume Kroll – is home to more than 1,600 companies.

Jacob J. Lew, de U.S. Treasury Secretary, deed op 27 juli 2014 in The Washington Post een dringende oproep om de wet van 2004 te wijzigen: Close the tax loophole on inversions. Een dringende oproep dat wel, maar de ondertoon is er een van machteloosheid. Het argument dat de gehele Amerikaanse infrastructuur (inclusief het formidabele defensiebudget) dreigt te kapseizen wanneer de gewone belastingbetaler (lees: de middenklasse) die alleen moet dragen, snijdt hout.

Anderzijds is het klaar dat de klassieke investeringstroeven zoals een hardwerkende en goed opgeleide bevolking, redelijke loonkosten, degelijk universitair onderwijs, goede wegen en havens, ondergeschikt geraken aan die ene vraag: wat is het taxpercentage in een land?

Vanuit Europees oogpunt is 'inversion' een bedreiging omdat - zoals gezegd - het taksvoordeel het wegkopen van Europese bedrijven faciliteert. Maar er is meer. Eens een multinational neerstrijkt in een EU-lidstaat en daar massaal de staatskas spijst, wordt die lidstaat als het ware een natuurlijke bondgenoot in Brussel om de op til zijnde merger niets in de weg te leggen. Wiens brood men eet, diens ... u weet wel. En omdat de concentratie van vermogens op een planetaire schaal gebeurt, is de democratische besluitvorming nationaal en internationaal in gevaar.

De verovering van de Senaat door de Republikeinen zal er geen goed aan doen.

Mme Judith Stelmach

Audience Research Department

Würzburggasse 30

A - 1136 - WIEN

Austria

Antwerp (Belgium), 1998-10-16

Dear Judith,

Please find hereby the Annual Report of the Flemish Licence Fee organisation (Dienst Kijk- en Luistergeld).

MERS is the external consultant for licence fee collection in Flanders, the Flemish speaking community of federalised Belgium.

On April 1st 1997 the service gained autonomy. Before that date the licence fee organisation was a part of Belgacom, the telecom operator of Belgium, privatised for some years now.

CIPAL, a service company in the informatic field and owned by a large number of cities in Flanders, took over the job (computer technology, organisation and management, etcetera). The Flemish government is the final responsable for and beneficiant of the tax collection. The public broadcast company (VRT) gets a dotation from the Flemish government but one can not say that there is an direct link between the taxes collected and the funding of the public broadcaster. This stays a political decision on a yearly basis. In some respect this situation makes the communication with the public rather difficult ("why you should pay licence fee"). Yet the collected licence fees are considered by the large majority as the main financial source for the VRT.

Note also that taxes are collected per household for TV-sets and per car for car radio.

As of April 1997 CIPAL undertook a number of successfull and speedy actions to improve the organisation of the service: new software, upgrading and training of personnel, large media campaign against tax evasion, etc.

All these efforts resulted in a dramatic rise of the registration rate in Flanders (see the tables in the annual report).

The situation in Flanders is somewhat special because of the very high penetration of cable (teledistribution). This makes it possible to match the databases of cable companies and the licence fee organisation on a nominative basis. This matching proces was made possible by law.

Great efforts go to the improvement of the matching methods because this is one of the keys for evasion rate reduction. The maps at the end of the annual report gives an insight in the evasion rate per province/city/village in Flanders (308 in total). The maps indicate where TV and car radio tax evasion is prominent and this information is to be considered as a management tool for specific and punctual action in the field.

It is my firm belief that international cooperation and data interchange can improve our business. Permanent improvement in tax collection can only evolve when brains work together and ideas flow around the globe.

Kind regards,

Lucas TESSENS

Managing Director MERS

Originally published in Winter 1984 on page 5

Copyright (c)1985, 1997 by Context Institute

HOWEVER NATURAL “owning” land may seem in our culture, in the long sweep of human existence, it is a fairly recent invention. Where did this notion come from? What does it really mean to “own” land? Why do we, in our culture, allow a person to draw lines in the dirt and then have almost complete control over what goes on inside those boundaries? What are the advantages, the disadvantages, and the alternatives? How might a humane and sustainable culture re-invent the “ownership” connection between people and the land?

These questions are unfamiliar (perhaps even uncomfortable) to much of our society, for our sense of “land ownership” is so deeply embedded in our fundamental cultural assumptions that we never stop to consider its implications or alternatives. Most people are at best only aware of two choices, two patterns, for land ownership – private ownership (which we associate with the industrial West) and state ownership (as in the Communist East).

Both of these patterns are full of problems and paradoxes. Private ownership enhances personal freedom (for those who are owners), but frequently leads to vast concentrations of wealth (even in the U.S., 75% of the privately held land is owned by 5% of the private landholders), and the effective denial of freedom and power to those without great wealth. State ownership muffles differences in wealth and some of the abuses of individualistic ownership, but replaces them with the often worse abuses of bureaucratic control.

Both systems treat the land as an inert resource to be exploited as fully as possible, often with little thought for the future or respect for the needs of non-human life. Both assume that land ownership goes with a kind of exclusive national sovereignty that is intimately connected to the logic of war.

In short, both systems seem to be leading us towards disaster, yet what other options are there?

The answer, fortunately, is that there are a number of promising alternatives. To understand them, however, we will need to begin by diving deeply into what ownership is and where it has come from.

THE HISTORICAL ROOTS

Beginnings Our feelings about ownership have very deep roots. Most animal life has a sense of territory – a place to be at home and to defend. Indeed, this territoriality seems to be associated with the oldest (reptilian) part the brain (see IN CONTEXT, #6) and forms a biological basis for our sense of property. It is closely associated with our sense of security and our instinctual “fight or flight” responses, all of which gives a powerful emotional dimension to our experience of ownership. Yet this biological basis does not determine the form that territoriality takes in different cultures.

Humans, like many of our primate cousins, engage in group (as well as individual) territoriality. Tribal groups saw themselves connected to particular territories – a place that was “theirs.” Yet their attitude towards the land was very different from ours. They frequently spoke of the land as their parent or as a sacred being, on whom they were dependent and to whom they owed loyalty and service. Among the aborigines of Australia, individuals would inherit a special relationship to sacred places, but rather than “ownership,” this relationship was more like being owned by the land. This sense of responsibility extended to ancestors and future generations as well. The Ashanti of Ghana say, “Land belongs to a vast family of whom many are dead, a few are living and a countless host are still unborn.”

For most of these tribal peoples, their sense of “land ownership” involved only the right to use and to exclude people of other tribes (but usually not members of their own). If there were any private rights, these were usually subject to review by the group and would cease if the land was no longer being used. The sale of land was either not even a possibility or not permitted. As for inheritance, every person had use rights simply by membership in the group, so a growing child would not have to wait until some other individual died (or pay a special fee) to gain full access to the land.

Early Agricultural Societies Farming made the human relationship to the land more concentrated. Tilling the land, making permanent settlements, etc., all meant a greater direct investment in a particular place. Yet this did not lead immediately to our present ideas of ownership. As best as is known, early farming communities continued to experience an intimate spiritual connection to the land, and they often held land in common under the control of a village council. This pattern has remained in many peasant communities throughout the world.

It was not so much farming directly, but the larger-than- tribal societies that could be based on farming that led to major changes in attitudes towards the land. Many of the first civilizations were centered around a supposedly godlike king, and it was a natural extension to go from the tribal idea that “the land belongs to the gods” to the idea that all of the kingdom belongs to the god-king. Since the god-king was supposed to personify the whole community, this was still a form of community ownership, but now personalized. Privileges of use and control of various types were distributed to the ruling elite on the basis of custom and politics.

As time went on, land took on a new meaning for these ruling elites. It became an abstraction, a source of power and wealth, a tool for other purposes. The name of the game became conquer, hold, and extract the maximum in tribute. Just as The Parable Of The Tribes (see IN CONTEXT, #7) would suggest, the human-human struggle for power gradually came to be the dominant factor shaping the human relationship to the land. This shift from seeing the land as a sacred mother to merely a commodity required deep changes throughout these cultures such as moving the gods and sacred beings into the sky where they could conveniently be as mobile as the ever changing boundaries of these empires.

The idea of private land ownership developed as a second step – partly in reaction to the power of the sovereign and partly in response to the opportunities of a larger-than- village economy. In the god-king societies, the privileges of the nobility were often easily withdrawn at the whim of the sovereign, and the importance of politics and raw power as the basis of ownership was rarely forgotten. To guard their power, the nobility frequently pushed for greater legal/customary recognition of their land rights. In the less centralized societies and in the occasional democracies and republics of this period, private ownership also developed in response to the breakdown of village cohesiveness. In either case, private property permitted the individual to be a “little king” of his/her own lands, imitating and competing against the claims of the state.

Later Developments By the early days of Greece and Rome, community common land, state or sovereign land, and private land all had strong traditions behind them. Plato and Aristotle both discussed various mixtures of private and state ownership in ideal societies, with Aristotle upholding the value of private ownership as a means of protecting diversity. As history progressed, the “great ownership debate” has continued between the champions of private interests and the champions of the state, with the idea of community common land often praised as an ideal, but in practice being gradually squeezed out of the picture. Feudal Europe was basically a system of sovereign ownership. The rise of commerce and then industrialism shifted power to the private ownership interests of the new middle class (as in the United States). The reaction against the abuses of industrialism during the past 150 years swung some opinion back again, bringing renewed interest in state ownership (as in the Communist countries).

As important as these swings have been historically, they have added essentially nothing to our basic understanding of, or attitudes about, ownership. Throughout the whole history of civilization land has been seen as primarily a source of power, and the whole debate around ownership has been, “To what extent will the state allow the individual to build a personal power base through land ownership rights?”

TAKING A FRESH LOOK

But the human-human power struggle is hardly the only, or even the most important, issue in our relationship to the land. Whatever happened to the tribal concerns about caring for the land and preserving it for future generations? What about issues like justice, human empowerment and economic efficiency? How about the rights of the land itself? If we are to move forward towards a planetary/ecological age, all of these questions and issues are going to need to be integrated into our relationship to the land. To do this we will have to get out beyond the narrow circle of the ideas and arguments of the past.

We have been talking about “ownership” as if it was an obvious, clear-cut concept: either you own (control) something or you don’t. For most people (throughout history) this has been a useful approximation, and it has been the basis of the “great ownership debate.” But if you try to pin it down (as lawyers must), you will soon discover that it is not so simple. As surprising as it may seem, our legal system has developed an understanding of “owning” that is significantly different from our common ideas and has great promise as the basis for a much more appropriate human relationship to the land.

Ownership Is A Bundle Of Rights The first step is to recognize that, rather than being one thing, what we commonly call “ownership” is in fact a whole group of legal rights that can be held by some person with respect to some “property.” In the industrial West, these usually include the right to:

use (or not use);

exclude others from using;

irreversibly change;

sell, give away or bequeath;

rent or lease;

retain all rights not specifically granted to others;

retain these rights without time limit or review.

These rights are usually not absolute, for with them go certain responsibilities, such as paying taxes, being liable for suits brought against the property, and abiding by the laws of the land. If these laws include zoning laws, building codes, and environmental protection laws, you may find that your rights to use and irreversibly change are not as unlimited as you thought. Nevertheless, within a wide range you are the monarch over your property.

No One Owns Land Each of these rights can be modified independent of the others, either by law or by the granting of an easement to some other party, producing a bewildering variety of legal conditions. How much can you modify the above conditions and still call it “ownership”? To understand the answer to this, we are going to have to make a very important distinction. In spite of the way we normally talk, no one ever “owns land”..In our legal system you can only own rights to land, you can’t directly own (that is, have complete claim to) the land itself. You can’t even own all the rights since the state always retains the right of eminent domain. For example, what happens when you sell an easement to the power company so that they can run power lines across you land? They then own the rights granted in that easement, you own most of the other rights, the state owns the right of eminent domain – but no single party owns “the land.” You can carry this as far as you like, dividing the rights up among many “owners,” all of whom will have a claim on some aspect of the land.

The wonderful thing about this distinction is that it shifts the whole debate about land ownership away from the rigid state-vs.-individual, all-or-nothing battle to the much more flexible question of who (including community groups, families, etc. as well as the state and the individual) should have which rights. This shift could be as important as the major improvement in governance that came with the shift from monolithic power (as in a monarchy) to “division of powers” (as exemplified in the U.S. Constitution with its semi-independent legislative, executive and judicial branches).

Legitimate Interests How might the problems associated with exclusive ownership (either private or state) be solved by a “division of rights” approach? To answer this, we need to first consider what are the legitimate interests that need to be included in this new approach. If we are to address all the concerns appropriate for a humane sustainable culture we need to recognize that the immediate user of the land (be that a household or a business), the local community, the planetary community, future generations, and all of life, all have legitimate interests. What are these interests?

The immediate users need the freedom to be personally (or corporately) expressive, creative, and perhaps even eccentric. They need to be able to invest energy and caring into the land with reasonable security that the use of the land will not be arbitrarily taken away and that the full equity value of improvements made to the land will be available to them either through continued use or through resale should they choose to move.

The local community needs optimal use of the land within it, without having land held arbitrarily out of use by absentee landlords. It needs to be able to benefit from the equity increases in the land itself due to the overall development of the community, and it needs security that its character will not be forced to change through inappropriate land use decisions made by those outside the community or those leaving the community.

The planetary community, future generations, and all of life need sustainable use – the assurance that ecosystems and topsoil that have been developed over hundreds of thousands of years will not be casually destroyed; that the opportunities for life will be enhanced; that non-renewal resources will be used efficiently and for long term beneficial purposes. This larger community also needs meaningful recognition that the earth is our common heritage.

Is it possible to blend these various interests in a mutually supportive way, rather than seeing them locked in a power struggle? The answer, fortunately, is yes. Perhaps the best developed alternative legal form that does this is called a land trust.

LAND TRUSTS

A land trust is a non-governmental organization (frequently a non-profit corporation) that divides land rights between immediate users and their community. It is being used in a number of places around the world including India, Israel, Tanzania, and the United States. Of the many types of land trusts, we will focus here on three – conservation trusts, community trusts, and stewardship trusts. These will be discussed in more detail in other articles in this section, but an initial overview now will help to draw together many of the threads we have developed so far.

In a conservation land trust, the purpose is generally to preserve some aspect of the natural environment. A conservation trust may do this by the full ownership of some piece of land that it then holds as wilderness, or it may simply own “development rights” to an undeveloped piece. What are development rights? When the original owner sells or grants development rights to the conservation trust, they put an easement (a legal restriction) on the land that prevents them or any future owners from developing the land without the agreement of the conservation trust. They have let go of the right to “irreversibly change” listed above. The conservation trust then holds these rights with the intention of preventing development. The Trust For Public Land (82 Second St, San Francisco, CA 94105, 415/495-4015) helps community groups establish conservation and agricultural land trusts.

A community land trust (CLT) has as its purpose removing land from the speculative market and making it available to those who will use it for the long term benefit of the community. A CLT generally owns full title to its lands and grants long term (like 99-year) renewable leases to those who will actually use the land. Appropriate uses for the land are determined by the CLT in a process comparable to public planning or zoning. Lease fees vary from one CLT to another, but they are generally more than taxes and insurance, less than typical mortgage payments, and less than full rental cost. The lease holders have many of the use and security rights we normally associate with ownership. They own the buildings on the land and can take full benefit from improvements they make to the land. They can not, however, sell the land nor can they usually rent or lease it without the consent of the trust. The Institute For Community Economics (57 School St. Springfield, MA 01105, 413/746-8660) is one of the major support groups for the creation of community land trusts in both urban and rural settings.

The stewardship trust combines features of both the conservation trust and the CLT, and is being used now primarily by intentional communities and non-profit groups such as schools. The groups using the land (the stewards) generally pay less than in a normal CLT, but there are more definite expectations about the care and use they give to the land.

In each one of these types, the immediate users (nonhuman as well as human) have clear rights which satisfy all of their legitimate use needs. The needs of the local community are met through representation on the board of directors of the trust which can enforce general land use standards. The larger community usually has some representation on the trust’s board as well. Thus by dividing what we normally think of as ownership into “stewardship” (the users) and “trusteeship” (the trust organization), land trusts are pioneering an approach that better meets all the legitimate interests.

The system is, of course, still limited by the integrity and the attitudes of the people involved. Nor are current land trusts necessarily the model for “ownership” in a humane sustainable culture. But they show what can be done and give us a place to build from. I’ll explore more of where we might build to in a later article, but now lets turn to other perspectives and experiences with going beyond ownership.

Bibliography

Chaudhuri, Joyotpaul, Possession, Ownership And Access: A Jeffersonian View (Political Inquiry, Vol 1, No 1, Fall 1973).

Denman, D.R., The Place Of Property (London: Geographical Publications Ltd, 1978).

Institute For Community Economics, The Community Land Trust Handbook (Emmaus, PA: Rodale Press, 1982).

International Independence Institute, The Community Land Trust (Cambridge, MA: Center For Community Economic Development, 1972).

Macpherson, C.B., Property: Mainstream And Critical Positions (Toronto: Univ Of Toronto Press, 1978).

Schlatter, Richard, Private Property: The History Of An Idea (New Brunswick, NJ: Rutgers University Press, 1951).

Scott, William B., In Pursuit Of Happiness: American Conceptions Of Property (Bloomington: Indiana University Press, 1977).

Tully, James, A Discourse On Property: John Locke And His Adversaries (Cambridge: Cambridge Univ Press, 1980).

Land Rights

by John Talbot

IT WAS NOT so long ago in human history that the rights of all humans were not acknowledged, even in the democracies. Slavery was only abolished a few generations ago. In the same way that we have come to see human rights as being inherent, so we are now beginning to recognize land rights, and by land I mean all life that lives and takes its nourishment from it, as well as the soil and earth itself. Once we have understood and accepted that idea, we can truly enter into a cooperative relationship with Nature. I’m not talking about living in fear of disturbing anything or a totally “hands off nature” angry ecologist view, but simply acknowledging the right to be of land and nature, and that when we do “disturb” it we do so with sensitivity and respect, doing our best to be in harmony with what is already there.

Being in harmony, apart from being a very subjective state, may not always be possible: for example in the case of putting a house down where once there wasn’t one. But we as humans have needs too. Nature knows that and is, I believe, quite willing to accommodate us. Our responsibility is, however, to act consciously and with the attitude of respect and desire for cooperation. It is no different from respecting other people’s rights in our interactions, being courteous and sensitive to their needs and feelings. This attitude toward the land is almost universally held by aboriginal and native peoples, from the Bushman to the Native American Indians to the tribes of the South Pacific. Earth Etiquette, you might say.

Following directly from that is the principle that you cannot really buy, sell or own the land. Just as we cannot (or should not) own slaves of our own species, we would not make slaves of animals, plants or the land and nature in general. Sounds easy but I feel this represents a very profound and fundamental change in human attitudes; one that takes thought, effort and time to reprogram in ourselves.

(Printable version of this text)

GENERAL ACT OF THE CONFERENCE AT BERLIN OF THE PLENIPOTENTIARIES OF GREAT BRITAIN, AUSTRIA-HUNGARY, BELGIUM, DENMARK, FRANCE, GERMANY, ITALY, THE NETHERLANDS, PORTUGAL, RUSSIA, SPAIN, SWEDEN AND NORWAY, TURKEY AND THE UNITED STATES RESPECTING: (1) FREEDOM OF TRADE IN THE BASIN OF THE CONGO; (2) THE SLAVE TRADE; (3) NEUTRALITY OF THE TERRITORIES IN THE BASIN OF THE CONGO; (4) NAVIGATION OF THE CONGO; (5) NAVIGATION OF THE NIGER; AND (6) RULES FOR FUTURE OCCUPATION ON THE COAST OF THE AFRICAN CONTINENT

In the Name of God Almighty.

Her Majesty the Queen of the United Kingdom of Great Britain and Ireland, Empress of India; His Majesty the German Emperor, King of Prussia; His Majesty the Emperor of Austria, King of Bohemia, etc, and Apostolic King of Hungary; His Majesty the King of the Belgians; His Majesty the King of Denmark; His Majesty the King of Spain; the President of the United States of America; the President of the French Republic; His Majesty the King of Italy; His Majesty the King of the Netherlands, Grand Duke of Luxemburg, etc; His Majesty the King of Portugal and the Algarves, etc; His Majesty the Emperor of all the Russias; His Majesty the King of Sweden and Norway, etc; and His Majesty the Emperor of the Ottomans,

WISHING, in a spirit of good and mutual accord, to regulate the conditions most favourable to the development of trade and civilization in certain regions of Africa, and to assure to all nations the advantages of free navigation on the two chief rivers of Africa flowing into the Atlantic Ocean;

BEING DESIROUS, on the other hand, to obviate the misunderstanding and disputes which might in future arise from new acts of occupation (prises de possession) on the coast of Africa; and concerned, at the same time, as to the means of furthering the moral and material well-being of the native populations;

HAVE RESOLVED, on the invitation addressed to them by the Imperial Government of Germany, in agreement with the Government of the French Republic, to meet for those purposes in Conference at Berlin, and have appointed as their Plenipotentiaries, to wit:

[Names of plenipotentiaries included here.]

Who, being provided with full powers, which have been found in good and due form, have successively discussed and adopted:

1. A Declaration relative to freedom of trade in the basin of the Congo, its embouchures and circumjacent regions, with other provisions connected therewith.

2. A Declaration relative to the slave trade, and the operations by sea or land which furnish slaves to that trade.

3. A Declaration relative to the neutrality of the territories comprised in the Conventional basin of the Congo.

4. An Act of Navigation for the Congo, which, while having regard to local circumstances, extends to this river, its affluents, and the waters in its system (eaux qui leur sont assimilées), the general principles enunciated in Articles 58 and 66 of the Final Act of the Congress of Vienna, and intended to regulate, as between the Signatory Powers of that Act, the free navigation of the waterways separating or traversing several States - these said principles having since then been applied by agreement to certain rivers of Europe and America, but especially to the Danube, with the modifications stipulated by the Treaties of Paris (1856), of Berlin (1878), and of London (1871 and 1883).

5. An Act of Navigation for the Niger, which, while likewise having regard to local circumstances, extends to this river and its affluents the same principles as set forth in Articles 58 and 66 of the Final Act of the Congress of Vienna.

6. A Declaration introducing into international relations certain uniform rules with reference to future occupations on the coast of the African Continent.

And deeming it expedient that all these several documents should be combined in one single instrument, they (the Signatory Powers) have collected them into one General Act, composed of the following Articles:

CHAPTER I

DECLARATION RELATIVE TO FREEDOM OF TRADE IN THE BASIN OF THE CONGO, ITS MOUTHS AND CIRCUMJACENT REGIONS, WITH OTHER PROVISIONS CONNECTED THEREWITH

Article 1

The trade of all nations shall enjoy complete freedom-

1. In all the regions forming the basin of the Congo and its outlets. This basin is bounded by the watersheds (or mountain ridges) of the adjacent basins, namely, in particular, those of the Niari, the Ogowé, the Schari, and the Nile, on the north; by the eastern watershed line of the affluents of Lake Tanganyika on the east; and by the watersheds of the basins of the Zambesi and the Logé on the south. It therefore comprises all the regions watered by the Congo and its affluents, including Lake Tanganyika, with its eastern tributaries.

2. In the maritime zone extending along the Atlantic Ocean from the parallel situated in 2º30' of south latitude to the mouth of the Logé.

The northern boundary will follow the parallel situated in 2º30' from the coast to the point where it meets the geographical basin of the Congo, avoiding the basin of the Ogowé, to which the provisions of the present Act do not apply.

The southern boundary will follow the course of the Logé to its source, and thence pass eastwards till it joins the geographical basin of the Congo.

3. In the zone stretching eastwards from the Congo Basin, as above defined, to the Indian Ocean from 5 degrees of north latitude to the mouth of the Zambesi in the south, from which point the line of demarcation will ascend the Zambesi to 5 miles above its confluence with the Shiré, and then follow the watershed between the affluents of Lake Nyassa and those of the Zambesi, till at last it reaches the watershed between the waters of the Zambesi and the Congo.

It is expressly recognized that in extending the principle of free trade to this eastern zone the Conference Powers only undertake engagements for themselves, and that in the territories belonging to an independent Sovereign State this principle shall only be applicable in so far as it is approved by such State. But the Powers agree to use their good offices with the Governments established on the African shore of the Indian Ocean for the purpose of obtaining such approval, and in any case of securing the most favourable conditions to the transit (traffic) of all nations.

Article 2

All flags, without distinction of nationality, shall have free access to the whole of the coastline of the territories above enumerated, to the rivers there running into the sea, to all the waters of the Congo and its affluents, including the lakes, and to all the ports situate on the banks of these waters, as well as to all canals which may in future be constructed with intent to unite the watercourses or lakes within the entire area of the territories described in Article 1. Those trading under such flags may engage in all sorts of transport, and carry on the coasting trade by sea and river, as well as boat traffic, on the same footing as if they were subjects.

Article 3

Wares, of whatever origin, imported into these regions, under whatsoever flag, by sea or river, or overland, shall be subject to no other taxes than such as may be levied as fair compensation for expenditure in the interests of trade, and which for this reason must be equally borne by the subjects themselves and by foreigners of all nationalities. All differential dues on vessels, as well as on merchandise, are forbidden.

Article 4

Merchandise imported into these regions shall remain free from import and transit dues.

The Powers reserve to themselves to determine after the lapse of twenty years whether this freedom of import shall be retained or not.

Article 5

No Power which exercises or shall exercise sovereign rights in the abovementioned regions shall be allowed to grant therein a monopoly or favour of any kind in matters of trade.

Foreigners, without distinction, shall enjoy protection of their persons and property, as well as the right of acquiring and transferring movable and immovable possessions; and national rights and treatment in the exercise of their professions.

PROVISIONS RELATIVE TO PROTECTION OF THE NATIVES, OF MISSIONARIES AND TRAVELLERS, AS WELL AS RELATIVE TO RELIGIOUS LIBERTY

Article 6

All the Powers exercising sovereign rights or influence in the aforesaid territories bind themselves to watch over the preservation of the native tribes, and to care for the improvement of the conditions of their moral and material well-being, and to help in suppressing slavery, and especially the slave trade. They shall, without distinction of creed or nation, protect and favour all religious, scientific or charitable institutions and undertakings created and organized for the above ends, or which aim at instructing the natives and bringing home to them the blessings of civilization.

Christian missionaries, scientists and explorers, with their followers, property and collections, shall likewise be the objects of especial protection.

Freedom of conscience and religious toleration are expressly guaranteed to the natives, no less than to subjects and to foreigners. The free and public exercise of all forms of divine worship, and the right to build edifices for religious purposes, and to organize religious missions belonging to all creeds, shall not be limited or fettered in any way whatsoever.

POSTAL REGIME

Article 7

The Convention of the Universal Postal Union, as revised at Paris 1 June 1878, shall be applied to the Conventional basin of the Congo.

The Powers who therein do or shall exercise rights of sovereignty or Protectorate engage, as soon as circumstances permit them, to take the measures necessary for the carrying out of the preceding provision.

RIGHT OF SURVEILLANCE VESTED IN THE INTERNATIONAL NAVIGATION COMMISSION OF THE CONGO

Article 8

In all parts of the territory had in view by the present Declaration, where no Power shall exercise rights of sovereignty or Protectorate, the International Navigation Commission of the Congo, instituted in virtue of Article 17, shall be charged with supervising the application of the principles proclaimed and perpetuated (consacrés) by this Declaration.

In all cases of difference arising relative to the application of the principles established by the present Declaration, the Governments concerned may agree to appeal to the good offices of the International Commission, by submitting to it an examination of the facts which shall have occasioned these differences.

CHAPTER II

DECLARATION RELATIVE TO THE SLAVE TRADE

Article 9

Seeing that trading in slaves is forbidden in conformity with the principles of international law as recognized by the Signatory Powers, and seeing also that the operations, which, by sea or land, furnish slaves to trade, ought likewise to be regarded as forbidden, the Powers which do or shall exercise sovereign rights or influence in the territories forming the Conventional basin of the Congo declare that these territories may not serve as a market or means of transit for the trade in slaves, of whatever race they may be. Each of the Powers binds itself to employ all the means at its disposal for putting an end to this trade and for punishing those who engage in it.

CHAPTER III

DECLARATION RELATIVE TO THE NEUTRALITY OF THE TERRITORIES COMPRISED IN THE CONVENTIONAL BASIN OF THE CONGO

Article 10

In order to give a new guarantee of security to trade and industry, and to encourage, by the maintenance of peace, the development of civilization in the countries mentioned in Article 1, and placed under the free trade system, the High Signatory Parties to the present Act, and those who shall hereafter adopt it, bind themselves to respect the neutrality of the territories, or portions of territories, belonging to the said countries, comprising therein the territorial waters, so long as the Powers which exercise or shall exercise the rights of sovereignty or Protectorate over those territories, using their option of proclaiming themselves neutral, shall fulfil the duties which neutrality requires.

Article 11

In case a Power exercising rights of sovereignty or Protectorate in the countries mentioned in Article 1, and placed under the free trade system, shall be involved in a war, then the High Signatory Parties to the present Act, and those who shall hereafter adopt it, bind themselves to lend their good offices in order that the territories belonging to this Power and comprised in the Conventional free trade zone shall, by the common consent of this Power and of the other belligerent or belligerents, be placed during the war under the rule of neutrality, and considered as belonging to a non-belligerent State, the belligerents thenceforth abstaining from extending hostilities to the territories thus neutralized, and from using them as a base for warlike operations.

Article 12

In case a serious disagreement originating on the subject of, or in the limits of, the territories mentioned in Article 1, and placed under the free trade system, shall arise between any Signatory Powers of the present Act, or the Powers which may become parties to it, these Powers bind themselves, before appealing to arms, to have recourse to the mediation of one or more of the friendly Powers.

In a similar case the same Powers reserve to themselves the option of having recourse to arbitration.

CHAPTER IV

ACT OF NAVIGATION FOR THE CONGO

Article 13

The navigation of the Congo, without excepting any of its branches or outlets, is, and shall remain, free for the merchant ships of all nations equally, whether carrying cargo or ballast, for the transport of goods or passengers. It shall be regulated by the provisions of this Act of Navigation, and by the rules to be made in pursuance thereof.

In the exercise of this navigation the subjects and flags of all nations shall in all respects be treated on a footing of perfect equality, not only for the direct navigation from the open sea to the inland ports of the Congo, and vice versa, but also for the great and small coasting trade, and for boat traffic on the course of the river.

Consequently, on all the course and mouths of the Congo there will be no distinction made between the subjects of riverain States and those of non-riverain States, and no exclusive privilege of navigation will be conceded to companies, corporations or private persons whatsoever.

These provisions are recognized by the Signatory Powers as becoming henceforth a part of international law.

Article 14

The navigation of the Congo shall not be subject to any restriction or obligation which is not expressly stipulated by the present Act. It shall not be exposed to any landing dues, to any station or depot tax, or to any charge for breaking bulk, or for compulsory entry into port.

In all the extent of the Congo the ships and goods in process of transit on the river shall be submitted to no transit dues, whatever their starting place or destination.

There shall be levied no maritime or river toll based on the mere fact of navigation, nor any tax on goods aboard of ships. There shall only be levied taxes or duties having the character of an equivalent for services rendered to navigation itself, to wit:

1. Harbour dues on certain local establishments, such as wharves, warehouses, etc, if actually used.

The tariff of such dues shall be framed according to the cost of constructing and maintaining the said local establishments; and it will be applied without regard to whence vessels come or what they are loaded with.

2. Pilot dues for those stretches of the river where it may be necessary to establish properly qualified pilots.

The tariff of these dues shall be fixed and calculated in proportion to the service rendered.

3. Charges raised to cover technical and administrative expenses incurred in the general interest of navigation, including lighthouse, beacon and buoy duties.

The lastmentioned dues shall be based on the tonnage of vessels as shown by the ship's papers, and in accordance with the rules adopted on the Lower Danube.

The tariffs by which the various dues and taxes enumerated in the three preceding paragraphs shall be levied shall not involve any differential treatment, and shall be officially published at each port.

The Powers reserve to themselves to consider, after the lapse of five years, whether it may be necessary to revise, by common accord, the abovementioned tariffs.

Article 15

The affluents of the Congo shall in all respects be subject to the same rules as the river of which they are tributaries.

And the same rules shall apply to the streams and river as well as the lakes and canals in the territories defined in paragraphs 2 and 3 of Article 1.

At the same time the powers of the International Commission of the Congo will not extend to the said rivers, streams, lakes and canals, unless with the assent of the States under whose sovereignty they are placed. It is well understood, also, that with regard to the territories mentioned in paragraph 3 of Article 1 the consent of the Sovereign States owning these territories is reserved.

Article 16

The roads, railways or lateral canals which may be constructed with the special object of obviating the innavigability or correcting the imperfection of the river route on certain sections of the course of the Congo, its affluents, and other waterways placed under a similar system, as laid down in Article 15, shall be considered in their quality of means of communication as dependencies of this river, and as equally open to the traffic of all nations.

And, as on the river itself, so there shall be collected on these roads, railways and canals only tolls calculated on the cost of construction, maintenance and management, and on the profits due to the promoters.

As regards the tariff of these tolls, strangers and the natives of the respective territories shall be treated on a footing of perfect equality.

Article 17

There is instituted an International Commission, charged with the execution of the provisions of the present Act of Navigation.

The Signatory Powers of this Act, as well as those who may subsequently adhere to it, may always be represented on the said Commission, each by one delegate. But no delegate shall have more than one vote at his disposal, even in the case of his representing several Governments.

This delegate will be directly paid by his Government. As for the various agents and employees of the International Commission, their remuneration shall be charged to the amount of the dues collected in conformity with paragraphs 2 and 3 of Article 14.

The particulars of the said remuneration, as well as the number, grade and powers of the agents and employees, shall be entered in the returns to be sent yearly to the Governments represented on the International Commission.

Article 18

The members of the International Commission, as well as its appointed agents, are invested with the privilege of inviolability in the exercise of their functions. The same guarantee shall apply to the offices and archives of the Commission.

Article 19

The International Commission for the Navigation of the Congo shall be constituted as soon as five of the Signatory Powers of the present General Act shall have appointed their delegates. And, pending the constitution of the Commission, the nomination of these delegates shall be notified to the Imperial Government of Germany, which will see to it that the necessary steps are taken to summon the meeting of the Commission.

The Commission will at once draw up navigation, river police, pilot and quarantine rules.

These rules, as well as the tariffs to be framed by the Commission, shall, before coming into force, be submitted for approval to the Powers represented on the Commission. The Powers interested will have to communicate their views with as little delay as possible.

Any infringement of these rules will be checked by the agents of the International Commission wherever it exercises direct authority, and elsewhere by the riverain Power.

In the case of an abuse of power, or of an act of injustice, on the part of any agent or employee of the International Commission, the individual who considers himself to be aggrieved in his person or rights may apply to the consular agent of his country. The latter will examine his complaint, and if he finds it prima facie reasonable he will then be entitled to bring it before the Commission. At his instance then, the Commission, represented by at least three of its members, shall, in conjunction with him, inquire into the conduct of its agent or employee. Should the consular agent look upon the decision of the Commission as raising questions of law (objections de droit), he will report on the subject to his Government, which may then have recourse to the Powers represented on the Commission, and invite them to agree as to the instructions to be given to the Commission.

Article 20

The International Commission of the Congo, charged in terms of Article 17 with the execution of the present Act of Navigation, shall in particular have power-

1. To decide what works are necessary to assure the navigability of the Congo in accordance with the needs of international trade.

On those sections of the river where no Power exercises sovereign rights the International Commission will itself take the necessary measures for assuring the navigability of the river.

On those sections of the river held by a Sovereign Power the International Commission will concert its action (s'entendra) with the riparian authorities.

2. To fix the pilot tariff and that of the general navigation dues as provided for by paragraphs 2 and 3 of Article 14.

The tariffs mentioned in the first paragraph of Article 14 shall be framed by the territorial authorities within the limits prescribed in the said Article.

The levying of the various dues shall be seen to by the international or territorial authorities on whose behalf they are established.

3. To administer the revenue arising from the application of the preceding paragraph (2).

4. To superintend the quarantine establishment created in virtue of Article 24.

5. To appoint officials for the general service of navigation, and also its own proper employees.

It will be for the territorial authorities to appoint sub-inspectors on sections of the river occupied by a Power, and for the International Commission to do so on the other sections.

The riverain Power will notify to the International Commission the appointment of sub-inspectors, and this Power will undertake the payment of their salaries.